Venmo

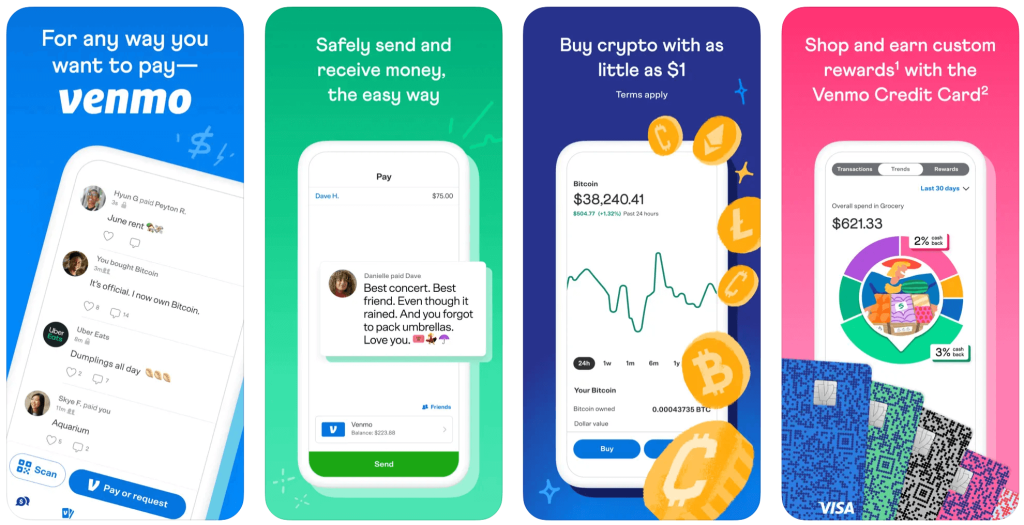

Venmo is a mobile payment app that originated in the United States and has been owned by PayPal since 2012. The app was initially designed for friends and family to split bills between themselves and one another. But it has now become an important payment option for businesses as well. The service lets users quickly and easily transfer money between their bank accounts to make payments and split bills.

The service also allows users to make payments using their credit or debit card. However, it does charge a fee for credit card payments. If you want to send money instantly, you should link your bank account with Venmo. Otherwise, you may have to wait for up to three days for the money to be transferred.

[quads id=4]

How to Download and Use Venmo

Once you have downloaded the Venmo application, you can sign up for an account using Facebook or your email. Then, you can choose to have your bank account information linked with your Venmo account. If you don’t want to link your bank account, you can skip this step. After signing up, the app will ask you to provide certain information, including your account number and routing number. Then, you can begin using Venmo!

Once you have verified your account, you can send money to friends. You can even add a note to explain the amount you are sending and the emoji to use. You can also make payments with your credit card or bank account. However, you must note that you will be charged a 3 per cent fee if you use your credit card to make a payment. Otherwise, payments made through your bank account or debit card will be free. You can also track your purchases using the Purchases tab. You can also see your recent transactions with your friends in the feed.

To withdraw money from Venmo, you must first sync your bank account with the app. Once you have done this, you can begin making payments or withdrawing funds from your Venmo account. Usually, your money will be transferred within 30 minutes, but it may take up to 3 days for the transfer to go through.

To use Venmo, first create an account. Next, connect your account with the person or business you would like to send money to. Once you’ve done that, click the “Pay” button to transfer money to that person. Once you’ve done this, you can select whom to pay and choose the amount and purpose for which you’d like to send the money. Once you’ve sent the money, you can also use an external payment method to complete the transaction.

[quads id=4]

What Are the Features of Venmo?

In addition to being a peer-to-peer payment service, Venmo offers social features and allows you to create a community of friends.

- Venmo is a P2P (Peer-to-Peer) digital payment service

Venmo is a peer-to-peer digital payment service that allows users to send and receive money instantly. It was originally designed as a payment system that works through text messages but has evolved into a social networking platform. Users can link their Venmo account to a bank account or credit card for secure transactions. They can also search for and add friends to their Venmo account and view all of their transactions.

- It charges a 3% fee for sending money

If you want to send money to friends, Venmo is the way to go. There are no fees to send money to friends, but there are some situations where you may need to pay a fee. Generally, you don’t need to pay a fee to send money to friends, but you will have to pay a fee if you want to transfer money to a business account. This fee applies whether the account is registered as a business or not.

- It offers a protection policy for sellers

Venmo’s new protection policy for sellers is an important improvement over its previous service, but there are some caveats. If you are selling on Venmo, be sure to read the fine print. If a transaction is not authorized, Venmo may put the payment on hold, delaying credit to your account for up to 21 days.