![]()

Afterpay

shopping | finance | installment payments

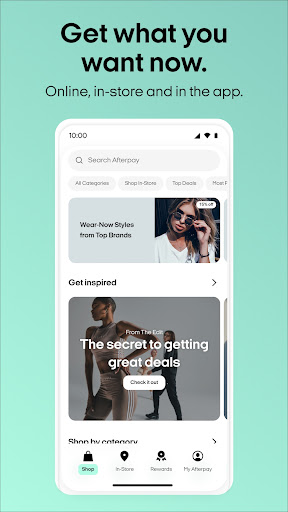

In the era of digital commerce, the Afterpay app has emerged as a game-changer, revolutionizing the way consumers shop and pay for their purchases. Afterpay offers a “buy now, pay later” service that allows users to make purchases instantly and pay for them in interest-free installments over time. With its seamless integration into online and physical stores, Afterpay provides a convenient and flexible shopping experience. This article delves into the features, benefits, pros, and cons of the Afterpay app, shedding light on how it has transformed the way we shop.

Features & Benefits

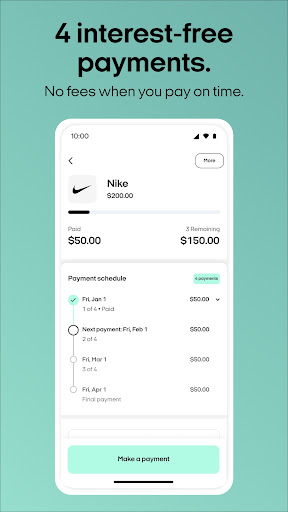

- Convenient Payment Options: Afterpay app provides users with a convenient alternative to traditional payment methods. It allows shoppers to split their purchases into four equal installments, paid every two weeks, without any interest fees. This flexibility makes it easier for users to manage their budgets and make purchases without the burden of large upfront payments.

- Instant Approval and Setup: The Afterpay app streamlines the payment process by offering instant approval and setup. Users can create an account within minutes, link their preferred payment method, and start using Afterpay immediately. The app’s user-friendly interface ensures a seamless onboarding experience, enabling shoppers to make purchases swiftly.

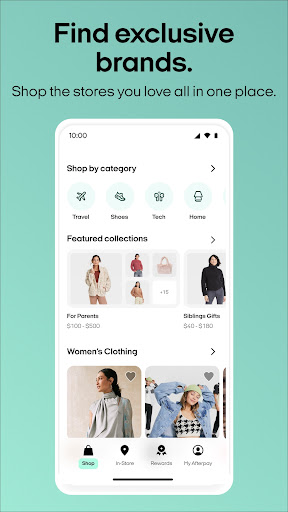

- Wide Merchant Acceptance: Afterpay has established partnerships with numerous online and physical retailers, making it widely accepted across various industries. From fashion and beauty to electronics and home goods, the app allows users to shop at their favorite stores and enjoy the convenience of the “buy now, pay later” model.

- Budgeting and Financial Control: The Afterpay app comes with built-in budgeting tools that empower users to stay on top of their spending. It provides clear visibility into upcoming payment due dates and allows users to set up personalized spending limits. These features help users manage their finances responsibly and avoid overspending.

- Enhanced Shopping Experience: By integrating seamlessly with online stores, Afterpay enhances the overall shopping experience. Users can view and manage their purchases, track deliveries, and even receive personalized offers and promotions from partnered merchants. The app creates a cohesive and convenient shopping ecosystem for users.

Pros

- Convenient and Budget-Friendly: Afterpay offers a convenient and budget-friendly payment solution. By splitting payments into installments, users can manage their expenses more effectively and avoid the burden of immediate full payment. This flexibility makes Afterpay a valuable tool for budget-conscious shoppers.

- Accessible to a Wide Range of Users: Afterpay’s instant approval and easy setup process make it accessible to a wide range of users. Whether you have a limited credit history or prefer not to use credit cards, Afterpay provides an inclusive payment option that does not rely on traditional credit checks or high credit limits.

- Interest-Free Installments: Afterpay’s interest-free installments make it an attractive alternative to credit cards or loans. Users can take advantage of the flexibility offered by Afterpay without incurring additional fees or interest charges. This feature helps users save money and avoid the pitfalls of high-interest debt.

- Seamless Integration with Online Retailers: Afterpay’s extensive network of online retailers ensures a seamless shopping experience. Users can enjoy the benefits of Afterpay across a wide range of stores, simplifying the payment process and providing a consistent user experience.

Cons

- Impact on Budgeting: While Afterpay offers flexibility in payments, it’s important for users to exercise caution and ensure that they can manage their installment payments within their budget. Splitting purchases into installments may lead to a false sense of affordability, potentially causing users to overspend or accumulate debt if not managed responsibly.

- Limited to Participating Retailers: Afterpay’s availability is dependent on its integration with specific online retailers. While the app has an extensive network of partnered stores, not all retailers offer Afterpay as a payment option. Users may encounter limitations when shopping at stores that do not support Afterpay, requiring alternative payment methods.

- Late Payment Fees: Afterpay sends payment reminders to users, but late payments can result in fees. Users need to be mindful of payment due dates and ensure they have sufficient funds in their accounts to cover the installment payments. Failure to make timely payments can lead to additional charges and impact credit scores.

Apps Like Afterpay

Klarna:?Klarna is a popular “buy now, pay later” app that allows users to split their purchases into installments and offers various payment options, including interest-free financing and flexible payments.

Sezzle:?Sezzle is a payment platform that enables users tosplit their purchases into four equal installments, with no interest or fees. It integrates seamlessly with online retailers and provides instant approval for users.

Quadpay:?Quadpay offers a “split it” payment option, allowing users to divide their purchases into four interest-free payments. The app is widely accepted at a range of retailers and offers a simple and transparent payment experience.

Screenshots

|

|

|

|

Conclusion

In conclusion, the Afterpay app has transformed the way we shop by offering a convenient and flexible payment solution. With its “buy now, pay later” model, instant approval process, and wide network of partnered retailers, Afterpay provides users with a seamless and enhanced shopping experience. While it promotes responsible spending and offers useful budgeting tools, users should be mindful of potential overspending and payment due dates to avoid unnecessary fees. Overall, Afterpay empowers consumers to shop on their terms and enjoy the benefits of convenient and interest-free installment payments.